The Assam Credit Guarantee Scheme is a government initiative implemented by the Government of Assam to support small and medium-sized enterprises (SMEs) in the state. The scheme aims to provide collateral-free credit facilities to eligible enterprises and promote entrepreneurship, economic growth, and job creation in Assam. It will also securitize financing for the medium and small companies of the state. Credit Guarantee Fund Trust for Micro and Small Enterprises(CGTMSE) and the government of Assam together launched the Credit Guarantee Scheme. The scheme will also help in fulfilling the financial need of the MSMEs in Assam.

Table of Contents

Assam Credit Guarantee Scheme 2024

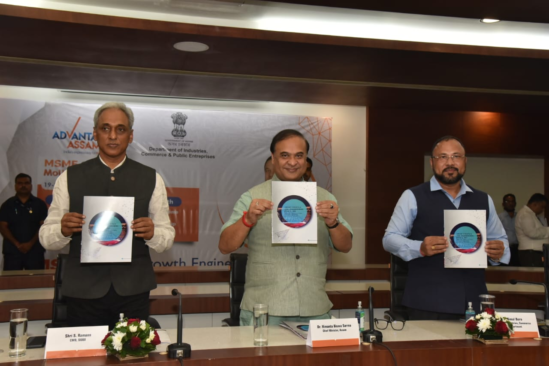

According to this scheme, 75% – 85% of the guarantee coverage for loan facilities will be provided by the CGTMSE based on the category of the borrower, and the balance of 25% – 15% coverage will be provided by the Assam government. The scheme came into effect from April 1, 2023. All the existing MLIS is allowed to take benefits of the scheme. These efforts of the state government will prove beneficial for medium-sized enterprises in the state. In 2022, the Assam government signed two Memorandums of Understanding (MoUs) with CGTMSE for the Assam Credit Guarantee Schemes and SIDBI Venture Capital for the Assam Startup Venture Capital Fund. The state government took this decision with the motive to allow rapid industrialization and revitalize the Micro, Small, and Medium Enterprises(MSME) sector.

Startup India Seed Fund Scheme

Details of Credit Guarantee Scheme Assam

| Name of the article | Assam Credit Guarantee Scheme |

| State | Assam |

| Beneficiaries | Small and medium-sized enterprises in the state |

| Launched by | Government of Assam |

| Aim | To support the Small and medium-sized enterprises of the state |

Objective of Assam Credit Guarantee Scheme

The state government started this scheme to promote entrepreneurship, economic growth, and job creation in the state. The aim of the scheme is to facilitate access to finance for small and medium-sized enterprises (SMEs). The scheme will provide collateral-free credit facilities and remove the barrier of collateral requirements. It will also enable SMEs to avail loans from lending institutions. The objective is to make sure that businesses have the necessary funds to meet their financial requirements and support their growth and expansion plans.

Credit Guarantee Scheme for Startups

Benefits of Assam Credit Guarantee Scheme

- This collaboration with CGTMSE will help in providing extra guarantee coverage for loans to MSMEs in the state.

- The scheme will offer collateral-free credit facilities to eligible enterprises.

- The scheme covers various types of credit facilities that SMEs may require.

- It will significantly enhance access to finance for small businesses.

- The scheme will promote entrepreneurship and support the establishment of new enterprises.

- By facilitating access to finance, the scheme encourages individuals to start their own businesses and fosters a favorable environment for entrepreneurial ventures.

How to Apply for Assam Credit Guarantee Scheme

As the scheme was recently announced by the CM of Assam, there is no certain application process revealed by the govt to apply for it. As soon as there is any information related to the application process, we’ll update you here.

Conclusion

The scheme is an important government initiative aimed at promoting entrepreneurship in the state of Assam. This initiative supports the growth and expansion of SMEs and encourages financial inclusion. By providing financial support to businesses, the scheme contributes to job creation, industrial growth, and enhanced productivity. It enables SMEs to invest in new technologies, expand their operations, and contribute to the overall development of many sectors in the state.