PAN Card Correction: The PAN (Permanent Account Number) card is an essential identity document for all Indian residents. Which is issued by the Income Tax Department of India. Permanent Account Number (PAN) serves as an important document required for tax filing and receiving tax refunds. If your details like name, date of birth, photo, signature, father’s name, Aadhaar, gender, address, or contact information are incorrect or changed. So to avoid these problems, your best step would be to make the necessary changes in your PAN card. Making changes to your PAN card is very simple and can be done both online and offline. Whose information we have given below in our article.

Table of Contents

PAN Card Correction 2024

Your Permanent Account Number (PAN) is an extremely important document. When your PAN card is printed, there may be mistakes in your name, parent’s name, or date of birth. There may be a change in your address or name after your PAN card is issued. In such cases, your name, parent’s name, address, or date of birth must be changed and updated on your PAN card. Stay tuned to our article till the end to know how you can use the PAN card update facility online and offline, the fees involved, the documents required, and much more.

How to Apply for PAN Card Correction Online?

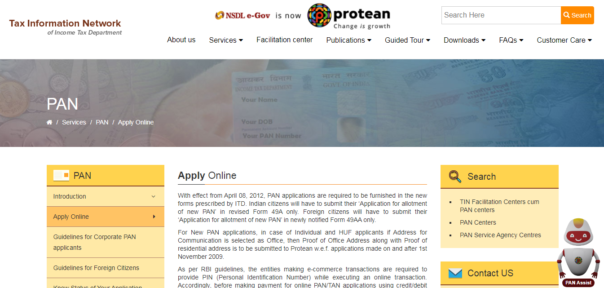

- First of all, go to the official website of NSDL and UTIITSL.

- The website home page will open on the screen.

- On the homepage, Select ‘Change/Correction in PAN card details’.

- Enter the ‘PAN Card’ number, and fill in the other details.

- Click on the submit button.

- Your request will be registered, and you will receive a token number on your email ID.

- Enter your necessary details and your ‘Aadhaar card’ number.

- Click on the next option.

- Select the option you want to update (name, address, or date of birth).

- Enter the updated details and other required details and upload the documents.

- Pay the required fees and apply.

- You will receive an acknowledgment of abe commercial number. Note down the number since it will be required to check the status of the correction application.

How to Apply for PAN Card Correction Offline?

- First of all, go to the official website of NSDL and UTIITSL.

- The website home page will open on the screen.

- Download the ‘Request For New PAN Card Or/ And Changes Or Correction in PAN Data’ application form.

- The information asked in the application form will have to be entered.

- Attach your signature and photograph to the application form.

- Submit the form and the required documents to the nearest PAN center.

- Pay the fees for PAN card updates/corrections.

- You will get the acknowledgment number from which you can track the status of your PAN card update application.

Download Digital Voter ID Card

Reasons for Changing the Name on a PAN Card

People alter their names on PAN cards for many reasons. Here are a few of the reasons.

- Wrongly spelt name in PAN card

- PAN card surname change after marriage

- Name changed legally

PAN Card Correction Form PDF Download Online?

You can download the PDF of the PAN card correction form, i.e. ‘Request For New PAN Card Or/ And Changes Or Correction in PAN Data’ application, by clicking here.

Documents Required for PAN Card Correction

| Proof of Identity | Proof of Address | Proof of Date of Birth |

| Aadhaar card | Aadhaar card | Aadhaar card |

| Voter’s ID | Voter’s ID | Voter’s ID |

| Driving license | Driving license | Electricity bill, landline bill, gas bill, or water bill not older than 3 months |

| Passport | Passport | Passport |

| Ration card | Matriculation certificate or mark sheet recognized board | Matriculation certificate or mark sheet recognised board |

| Arm’s license | Latest property tax assessment order | Birth certificate |

| Photo identity card issued by the Central or State Government or Public Sector Undertaking (PSU) | Domicile certificate issued by the Government | Domicile certificate |

| Property registration document | Pension payment order | |

| Electricity bill, landline bill, gas bill or water bill not older than 3 months | Photo identity card issued by the Central or State Government or PSU |

Identity and proof of address of foreign citizens are as follows:

| Proof of Identity | Proof of Address |

| Copy of passport | Copy of passport |

| Copy of Person of Indian Origin (PIO) card issued by the Government of India | Copy of Person of Indian Origin (PIO) card issued by Government of India |

| Copy of Overseas Citizen of India (OCI) card issued by Government of India | Copy of Overseas Citizen of India (OCI) card issued by Government of India |

| Copy of other natural, taxpayer identification number, or citizenship identification number duly attested by Apostille, High Commission, Indian Embassy or Consulate in the country where the applicant is located | Copy of bank account statement in the country of residence |

| Copy of registration certificate issued by the Foreigner’s Registration Office showing Indian address | |

| Copy of other natural, taxpayer identification number, or citizenship identification number duly attested by Apostille, High Commission, Indian Embassy or Consulate in the country where the applicant is located |

proof of identity and address for companies, firms, and artificial judicial persons are as follows:

| Type of Applicant | Documents |

| Company | Copy of registration certificate issued by Registrar of Companies (ROC) |

| Partnership Firm | Copy of registration certificate issued by Registrar of firms or partnership deed |

| Limited Liability Partnership | Copy of registration certificate issued by the Registrar of LLPs |

| Trust | Copy of registration certificate number or agreement issued by the registrar of cooperative society, charity commissioner, other competent authority, document originating from any department of Central or State Government showing identity and address |

| Association of Person, Local Authority, Body of Individuals, or Artificial Juridical Person | Copy of registration certificate number or agreement issued by registrar of cooperative society, charity commissioner, other competent authority, document originating from any department of Central or State Government showing identity and address |

Processing Charges For PAN Card Correction

| Mode of submission of PAN application documents | Particulars | Fees (inclusive of applicable taxes) |

| PAN application submitted using physical mode for physical dispatch of PAN card | Dispatch of physical PAN card in India | 107 |

| Dispatch of physical PAN card outside India | 1,017 | |

| PAN application submitted through paperless modes for physical dispatch of PAN card | Dispatch of physical PAN card in India | 101 |

| Dispatch of physical PAN card outside India | 1,011 | |

| PAN application submitted using physical mode for e-PAN card | e-PAN card dispatched at the email ID of the applicant | 72 |

| PAN application submitted through paperless modes for e-PAN card | e-PAN card dispatched at the email ID of the applicant | 66 |

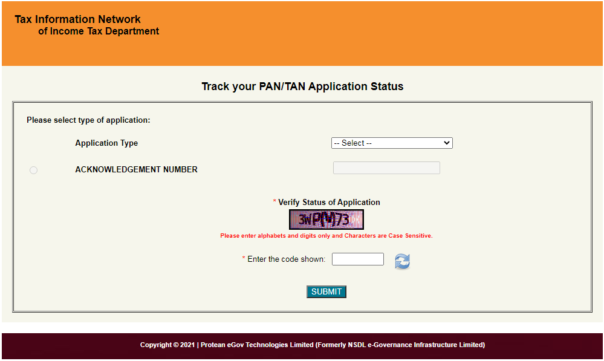

How to Check PAN Card Correction Status?

- First of all, go to the official website of NSDL and UTIITSL.

- The website home page will open on the screen.

- After that, Click the ‘Know Status of PAN application’ or ‘Track PAN card’ option.

- Enter the ‘Acknowledgement Number’ and Captcha code.

- Click on the submit button.

- The status of the correction application will be displayed on the screen.

Steps to Change Your Name on a PAN card?

- First of all, go to the official website of NSDL and UTIITSL.

- The website home page will open on the screen.

- Select the ‘Change/Correction in PAN card details’.

- Enter the ‘PAN Card’ number.

- Now click on the submit button.

- A new page will open on the screen.

- After that, Select the name option and enter the changed/updated name.

- Upload the required documents, pay the required fees, and submit the application.

- You will receive an acknowledgment number.

- Take a printout of the acknowledgment, attach the documents, and send it to the NSDL office at Pune or UTIITSL offices in Kolkata, Mumbai, New Delhi, or Chennai.

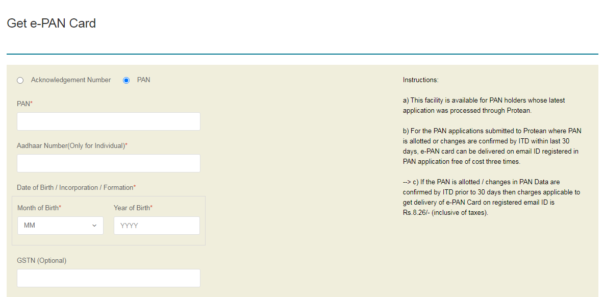

How to Download an Updated PAN Card?

- First of all, go to the official website of the NSDL PAN website or the UTIITSL website.

- After that click on the download e–PAN /e–PAN XML option.

- Enter the PAN number, date of birth, GSTIN (if applicable), and Captcha code.

- Click on the submit button.

FAQs

What is the fee to change the details on a PAN card?

In the case of offline applications, the fee for PAN card correction is Rs.110. The applicant must pay an extra dispatch fee of Rs.910 if the PAN card is to be sent abroad.

Can I change my PAN number online?

Online or offline PAN number changes are not possible. The PAN card’s other information, however, can be updated.

How long does it take for PAN card correction?

Typically, it takes about 15 days for PAN card correction. When your PAN card is sent out via post, a text message will be sent to the registered mobile number you provided.