Stand Up India Scheme:- The government of India continues to execute numerous programs to move its nation toward development, which directly benefits the locals. The Stand Up India Scheme is one such program that the government has launched to support women in leadership positions. This great program was started by India’s Honorable Prime Minister Shri Narendra Modi to encourage female entrepreneurs in areas of Scheduled Castes and Scheduled Tribes. Read below to get detailed information related to the Stand Up India Loan Scheme like highlights, objectives, features and benefits, eligibility criteria, documents required, the application process, login process, steps to check the details of Health Centers Across India, and much more

Table of Contents

Stand Up India Scheme 2024

A Stand Up India Loan Scheme has been introduced by the Indian government. Bank loans are made available to women, scheduled castes, and scheduled tribes under this program. The amount of these bank loans would range from Rs. 10 lakh to Rs. With the aid of this program, each bank branch will be able to offer a loan for the establishment of a Greenfield Enterprise to at least one borrower who belongs to a scheduled caste or tribe and at least one woman. This business may be in the manufacturing, service, agriculturally related, or trading sectors. If the business is not owned by a single person, SC/ST or female entrepreneurs must own at least 51% of the shares and control of the company.

This program has been established to assist SC/ST and female entrepreneurs in starting businesses, securing financing, and providing additional support that may be occasionally required. All scheduled commercial bank branches will be covered by this program, either directly at the branch or via the lead district manager’s SIDBI stand-up India site.

Startup India Seed Fund Scheme

Stand Up India Loan Scheme Details Highlights

| Scheme Name | Stand Up India Loan Scheme |

| Introduced By | Indian Government |

| Year | 2024 |

| Beneficiaries | Indian Citizens |

| Objective | To offer financial support for starting a business |

| Benefits | Loan Benefit of 10 lakh to 1 Crore rupees |

| Application Mode | Online |

| Official Website | www.standupmitra.in |

Stand Up India Scheme Objective

The primary goal of the Standup India loan program is to provide funding assistance for the establishment of Greenfield Businesses. Through this program, SC, ST, or women entrepreneurs can receive financial assistance ranging from Rs. 10 lakh to Rs. 1 crore. This program will make it easier for SC, ST, and women business owners to launch new ventures, access loans, and receive other support that may be occasionally required. Additionally, by implementing this plan, employment will be created, lowering the unemployment rate. The stand-up India loan scheme will benefit around 2.5 lakh beneficiaries through 1.25 lakh banks.

Stand Up India Scheme Benefits

Some of the key features & benefits of the Stand Up India Loan Scheme are as follows:

- The Stand-up India program does not provide the applicant with any type of subsidy.

- The credit offered through the program will only be used to launch new businesses in the manufacturing, services, and trade sectors.

- The maximum moratorium term has been maintained at 18 months, while the loan payback period is limited to 7 years.

- The stand-up scheme’s minimum age requirement of 18 years has been maintained.

- All SC, ST, and women business owners in the nation are eligible to apply for the financing program

- The applicant must not be in default with any bank or NBFC to receive benefits under this scheme.

- An online procedure will be created for the portal’s complaint submission and subsequent tracking.

- The Prime Minister of the nation launched the Stand Up India Loan Scheme to lead his nation toward growth.

- The advantage in the loan amount from bank assistance can range from Rs. 10 lakh to Rs. 1 crore.

- Only a manufacturing, service, agriculturally related activity, or commercial sector will be eligible for this loan.

- The borrower will be asked to contribute his own money equal to at least 10% of the project’s cost.

- The applicant will be given a total loan equal to 85% of the project’s cost, including a term loan and working capital.

Eligibility Criteria for Stand Up India Loan Scheme

The Eligibility Criteria for the Stand Up India Loan Scheme are as follows:

- The candidate needs to be an Indian permanent resident to benefit from this program.

- Applicants must be at least 18 years old to be eligible.

- The applicant must belong to a Scheduled Caste, Scheduled Tribe, or be a woman entrepreneur to qualify for the scheme’s benefits.

- In the event of non-individual businesses, SC, ST, or female business owners must own 51% of the shares and the controlling interest.

- The applicant cannot have a history of a financial institution or bank default under the program.

- Loans will only be given out under the Stand Up India Loan Scheme for new construction projects.

Documents Required for Stand Up India Scheme

The documents required for the Stand Up India Loan Scheme are as follows:

- Passport size photograph

- Mobile number

- Aadhar card of the applicant

- Permanent residence certificate

- Caste certificate

- Application loan form

- Age certificate

- Email ID

Steps to Apply for Stand Up India Scheme

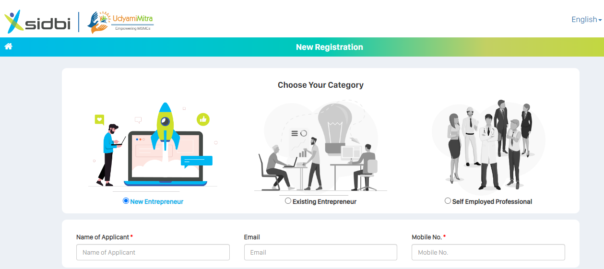

Applicants need to follow the below-given steps to apply for Stand Up India Loan Scheme

- First of all, go to the official website of the Stand Up India Loan Scheme

- The homepage of the website will open on the screen

- Click on the option Click here for handholding support or apply for a loan link

- A new page will open on the screen

- Now, select your category, and enter your name, email id, and mobile number

- After that click on the Generate OTP button

- An OTP will be sent to your registered mobile number

- Enter the received OTP in the specified space and click on the Register button to complete the registration process

- After that, click on the Login button

- The login page will open on the screen

- Now, enter the login credentials to get logged in to your registered account

- The dashboard of your account on your screen

- Click on the Stand Up India Loan Scheme option

- An application form will open on your screen

- Now enter all the required details

- After that upload all the required documents

- Finally, click on the submit button to submit your application form

Information Required while Applying for a Loan

The information required while applying for a Loan is as follows:

- Class

- Borrower’s location

- Nature of Business

- Assistance needed for the preparation of the project plan

- Availability of space to conduct business

- Skills and training required

- Own investment in the project

- Bank account details

- Any previous experience in business

- Need help raising margin money

Steps to Login on the Portal

To log in to the Portal, the user needs to follow the below-given steps:

- First of all, go to the official website of Stand Up India Loan Scheme i.e., https://www.standupmitra.in/

- The homepage of the website will open on the screen

- Click on the login button

- Once you will click on the login button, two options will open on the screen i.e.,

- Applicant

- Other users

- Select one of the options

- After that enter your username and password

- Finally, click on the login button to get logged in to your registered account

Steps to Track Application Status

To track the application status of the Stand Up India Loan Scheme, the applicant needs to follow the below-given steps:

- First of all, go to the official website of the scheme

- The homepage of the website will open on the screen

- Click on the Track Application Status

- A new page will open on the screen

- Now, enter your mobile number and click on the Request OTP button

- After that, enter the received OTP in the specified space

- Now, enter your reference number

- Finally, click on the track option to track the status of your application

Steps to Check the Details Of Health Centers Across India

To check the details of Health Centers Across India, applicants need to follow the below-given steps:

- First of all, go to the official website of the scheme

- The homepage of the website will open on the screen

- Click on the Help Centers Across India

- A new page will open on the screen

- Now, select the state, district, expertise, and agency name

- After that click on the search button to check the details of Health Centers Across India

Steps to Check Details about LDM

To check details about LDM, applicants need to follow the below-given steps:

- First of all, go to the official website of the scheme

- The homepage of the website will open on the screen

- Click on the LDM option

- A new page will open on the screen

- Now, select the desired state, district, specialization, and agency name

- After that click on the search button to check the details of LDM

Steps to Check the Details about Connect Centers

To check details about Connect Centers, applicants need to follow the below-given steps:

- First of all, go to the official website of the scheme

- The homepage of the website will open on the screen

- Click on the Connect Centers option

- After that, a new page will be displayed in front of you.

- Now, select the desired state, district, specialization, and agency name

- After that click on the search button to check the details of Connect Centers

Contact Details

For any other query related to the Stand Up India Loan Scheme, feel free to contact us at the below-given details:

Email Id:

support@standupmitra.in

help@standupmitra.in

National Helpline Toll-Free Number: 1800-180-1111