e-RUPI Digital Payment:- Mr Narendra Modi, India’s honourable Prime Minister, has undertaken various digital initiatives. In India, there has been a digital revolution in the previous few years. Citizens have become more aware of digital payment methods, which have enhanced their living standards. You will learn about the e-RUPI Digital Payment platform in this article. This platform serves as a means for its users to make digital payments. By reading this post, you will learn everything there is to know about this payment system, including its goal, benefits, how it works, and how to download it.

Table of Contents

e-RUPI Digital Payment

The National Payments Corporation of India (NPCI) created E-Rupi in collaboration with three departments:

- The National Health Authority

- The Ministry of Health and Family Welfare, and

- The Department of Financial Services.

It is described as a personalised and purpose-specific digital payment solution. Prime Minister, Mr Narendra Modi, unveiled the e-RUPI Digital Platform, a digital payment platform. This platform will be used to make digital payments and will be cashless and contactless. It is a QR code or SMS string-based e-voucher that is sent to the users’ mobile phones. This voucher can be redeemed without the need for a digital payment app, internet banking, or a card. The Department of Financial Services, the Ministry of Health and Family Welfare, and the National Health Authority are the collaborators. This project will bring together the service sponsor, the beneficiaries, and the service providers. The link will be maintained digitally, with no physical interface.

Old Pension Scheme vs New Pension Scheme

e-RUPI Digital Payment Details in Highlights

| Name of Article | e-RUPI Digital Payment Solution |

| Launched by | Government Of India |

| Beneficiaries | Citizens Of India |

| Major Benefit | To Provide Cashless And Contactless Instrument For Making Digital Payments |

| Article Objective | To provide a digital payment system environment |

| Article under | Central Government |

| Name of State | All India |

| Official Website | www.npci.org.in |

e-RUPI Voucher Limit Increased

The Central Bank of India has increased the limit on government-issued e-RUPI Digital vouchers in order to facilitate the transfer of more benefits to the general public. The Reserve Bank of India is raising the maximum e-RUPI voucher limit from Rs 10,000 to Rs 1 lakh. Single vouchers can be used several times till the balance is depleted. Previously, e-RUPI was only available as a one-time voucher. Last August, this coupon was introduced. This voucher is compatible with India’s national payment corporation’s unified payment interface platform. The government is primarily issuing e-RUPI vouchers for covid-19 vaccination. Other instances are being actively considered by various state and federal administrations. This voucher is issued by 16 banks, with 8 banks acting as e-RUPI acquirers.

Digital Voter ID Card Download

e-RUPI Digital Payment Platform Uses

The payment to the service provider will be paid only after the transaction is completed through the e-RUPI platform. This payment mechanism will be prepaid, which means that the service provider will not be compensated through an intermediary. Aside from that, this platform can be used to deliver services under schemes that provide drugs and nutritional assistance, such as the mother and child welfare scheme, the TB eradication programme, and drug and diagnostic under the Ayushmann Bharat Pradhan Mantri Jan Arogya Yojana, fertiliser subsidies, and so on. These digital tokens can also be used by the private sector for employee welfare and corporate social responsibility projects. This programme will provide leak-proof revolutionary delivery of welfare services.

Procedure for Issuing Vouchers

On the UPI platform, the National Payment Corporation of India developed the e-RUPI digital payment system. The Indian National Payment Corporation has onboard banks that would be the voucher’s issuing authority. The company or government agency must approach a partner bank (including private and public sector lenders) with information about the specific person and purpose for which the payment is needed. Beneficiaries will be identified using the bank-issued mobile phone voucher. This platform will be a ground-breaking digital effort, aimed at raising the standard of living and simplifying the payment process.

The Indian National Payment Corporation

The National Payment Corporation of India is in charge of running India’s retail payment and settlement systems. The Reserve Bank of India and the Indian Banks’ Association founded this institution. In order to build a strong payment and settlement infrastructure in India, this institution works under the provisions of the Payment and Settlement Systems Act of 2017. The National Payment Corporation of India is a non-profit corporation that operates under the Companies Act of 2013. NPCI is also in charge of using technology to maintain the banking system’s infrastructure in India, including physical and electronic payment and settlement systems.

This organisation focuses on using technology to bring innovation to the payment system. State Bank of India, Punjab National Bank, Bank of Baroda, Canara Bank, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank, and HSBC are the promoter banks of NPCI.

Launching Of e-RUPI Digital Payment Platform

The e-RUPI digital platform was introduced via video conferencing on August 2, 2021. Prime Minister Mr Narendra Modi has introduced e-RUPI through video conferencing. Along with the Prime Minister, the chief executive chairman of the National Health Authority presented features of the platform at its debut. On the occasion of the platform’s debut, the first implementation of E-RUPI digital payment was shown in a private Mumbai vaccination centre.

e-RUPI Digital Payment Objective

The e-RUPI digital payment platform’s major goal is to establish a cashless and contactless payment system that allows citizens to make digital payments with ease. Users can make secure payments with the assistance of this payment platform. This payment mechanism employs a QR code or SMS string-based e-voucher that is transmitted to the beneficiary’s mobile phone. The e-RUPI digital payment platform ensures that services are paid on time without the need for an intermediary. Users will not need to carry any cards or digital payment apps, nor will they need online banking access to make payments, making the process simple and secure.

List Of Banks That Are Live With e-RUPI

| Name of Banks | Issuer | Acquirer | Acquiring App |

| Union Bank of India | Yes | No | NA |

| State bank of India | Yes | Yes | YONO SBI Merchant |

| Punjab national bank | Yes | Yes | PNB Merchant Pay |

| Kotak bank | Yes | No | NA |

| Indian bank | Yes | No | NA |

| Indusind bank | Yes | No | NA |

| ICICI bank | Yes | Yes | Bharat Pe and PineLabs |

| HDFC bank | Yes | Yes | HDFC Business App |

| Canara bank | Yes | No | NA |

| Bank of Baroda | Yes | Yes | BHIM Baroda Merchant Pay |

| Axis bank | Yes | Yes | Bharat Pe |

e-RUPI Digital Payment Features

- On August 2, 2021, India’s honourable Prime Minister, Mr Narendra Modi, will unveil the e-RUPI digital platform, a digital payment platform.

- This platform will be both cashless and contactless.

- Users can use this method to make digital payments using e-vouchers based on QR codes or SMS strings.

- This voucher will be sent to the users’ cell phones.

- This voucher can be redeemed without the need of a payment app, online banking, or a credit card.

- On the UPI platform, the National Payment Corporation of India has developed the e Rupi Digital Payment service.

- The Department of Financial Services, the Ministry of Health and Family Welfare, and the National Health Authority are among the collaborators.

- The sponsor of services will be linked to the recipients and service providers through this programme. This connection will be made entirely digitally, with no physical interface.

- Payment to the service provider will be paid after the transaction is completed via this platform.

- Prepaid is the essence of this payment platform.

- Payment is not required by e-RUPI for any service provider.

- This platform can also be utilised to provide services under programmes that provide medications and nutritional assistance.

West Bengal Digital Ration Card

e-RUPI Digital Payment Benefits

| Benefits for Consumers | The payment process is completely contactless. Only a two-step redemption procedure is required. Any type of digital payment app or bank account is required. The consumer is not obligated to submit any personal information to protect your privacy, |

| Benefits for Hospitals | Because the voucher is pre-paid, the transaction is fully secure. In just a few steps, you may redeem your voucher. Because hospitals are not required to handle currency, payments can be made in a hassle-free and contactless manner. A verification code authorises the voucher, making the payment procedure simple and secure. |

| Benefits for Corporates | Employee happiness can be enhanced by the distribution of corporate vouchers. Because the transactions are digital and do not involve any physical issuance, the issuer may follow the voucher redemption in a speedy, safe, and frictionless manner, resulting in cost savings. |

NPCI Other Services

The National Payment Corporation of India is in charge of running India’s retail payment and settlement systems. The national payment company provides the citizens of India with the following services:

Unified Payment Interface (UPI)

A person’s many bank accounts can be merged into a single mobile application using this feature.

Rupee and Payment (RuPay)

It is an Indian domestic card payment network that accepts payments at ATMs, point-of-sale terminals, and e-commerce websites across the country. It is a safe network that protects users from phishing attacks.

Bharat Interface For Money (BHIM)

BHIM is an app that allows you to use your unified payment interface to make simple, easy, and rapid payments and transactions. BHIM allows users to make instant bank-to-bank payments and collect money using only a cellphone number or a virtual payment address.

National Automated Clearing House (NACH)

Interbank high-volume electronic transactions that are repeated and periodic are facilitated using NACH. Banks, financial institutions, corporations, and the government all use this platform.

Immediate Payment Service (IMPS)

Interbank electronic fund transfers are available 24 hours a day, seven days a week, through a variety of channels including mobile, internet, ATM, SMS, and others. It is a reliable and real-time financial transfer technology that transfers funds between banks across the country in real time. IMPS is completely secure and cost-effective.

National Electronic Toll Collection (NETC)

The Countrywide Payment Corporation of India has built a national electronic toll collection system to fulfil the Indian market’s electronic tolling needs. This platform provides a nationwide toll payment system that includes a clearing house service for settlement and dispute resolution.

BHIM Aadhaar

Merchants are unable to receive digital payments from clients using BHIM Aadhaar. Aadhaar authentication is used on this platform. Merchants can accept payment from bank clients by validating their biometrics using this technology.

Adhaar Enabled Payment System(AePS)

Aadhaar authentication is used to conduct an online interoperable financial inclusion transaction at the point of sale through the bank’s business correspondent. This platform supports six different types of transactions. To make a payment, customers simply need to enter their bank name, Aadhaar number, and fingerprint collected during enrollment.

National Financial Switch(NFS)

It is a 37-member network that connects 50,000 ATMs. This platform creates in-house operational models that are powerful and long-lasting. National financial switch’s operational functions and services are comparable to those of other global ATM networks.

Cheque Truncation System(CTS)

It is a method of clearing checks electronically rather than physically processing them. This is done by presenting a bank on the way to the paying bank branch. This platform is managed by the National Payment Corporation of India. This technique will also save a significant amount of time.

Highlights from the National Health Authority’s Chief Executive Chairman

The National Health Authority’s chief executive chairman has praised the e-RUPI initiative, which was established as part of the Digital India goal. He has stated that this payment platform is as crucial to BHIM UPI.This platform is an individual and purpose-specific instrument built on the UPI architecture. He has also emphasised the instrument’s purpose-specific character. Currently, the government and other institutions are not obligated to provide funds for various forms of benefits. They can provide this voucher instead of money, and the beneficiary can only use it for the reason for which it was issued.

- This platform is both paperless and real-time. This platform will be useful for departments such as health, nutrition, and education. It can also be utilised to support the national Digital Swasthya mission. The Reserve Bank of India recognises this voucher.

- Direct fund transfers to the service provider can be conducted using this platform. This voucher can only be used once.

Highlights from Prime Minister Narendra Modi

- The Prime Minister of India has underlined several benefits of the e-RUPI platform on the occasion of its debut.

- He has emphasised the importance of this endeavour in terms of digital governance.

- Digital transactions may be made effortlessly with the help of this platform, and it will play an important part in making digital payments effective.

- This voucher will assist in making targeted, transparent, and leakage-free transactions.

- The Prime Minister has also emphasised that India is making progress thanks to digital technology.

- Citizens’ living standards are rising, and technology is playing an increasingly important role in their lives.

- He has also expressed his thankfulness that this project is being launched on Amrit Mahotsav, the nation’s 75th anniversary of independence.

- This voucher can be utilised not just by the government, but also by non-governmental organisations (NGOs) to aid people with education, health, and other issues.

- This programme will ensure that funds given to recipients are used for the same purpose.

- Only health-related benefits will be covered in the first phase of this scheme.

- The prime minister gave several examples of how this voucher could be used, including vaccination drives, old age homes, and hospitals.

- This voucher is for a specific person and purpose.

- This voucher can only be used by the person who received it.

- He also emphasised the significance of technology.

- The launch of this platform was aided greatly by banks and payment gateways.

- Many private hospitals, corporations, enterprises, non-governmental organisations, and other organisations have expressed interest in the e-RUPI platform.

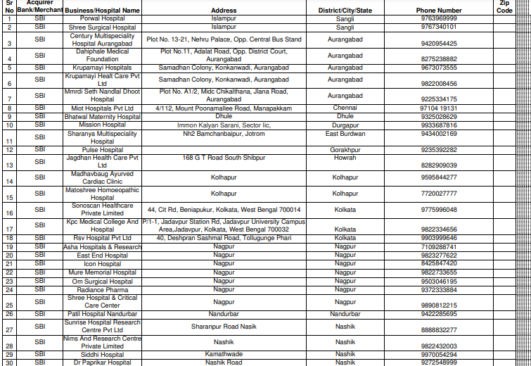

View List Of Live Hospitals On e-RUPI Digital Payment

- To begin, go to the official website of India’s National Payment Corporation.

- The home page will appear in front of you.

- Click the What We Do option on the homepage.

- The next step is to select UPI.

- Following that, you must select e-RUPI live partners.

- After that, go to Live Hospitals on e-RUPI.

- A PDF file will open in front of you.

- This PDF file contains a list of active e-RUPI hospitals.

Download the e-RUPI Mobile App for Digital Payments

- To begin, go to the Google Play store or Apple App Store on your smartphone.

- You must now type e-RUPI Digital payment into the search box.

- After then, you must select Search.

- A list of apps will appear in front of you.

- You must select the first option.

- After that, you must select Install.

- Your smartphone will download the e-RUPI digital payment mobile app.

How to Redeem an e-RUPI Voucher

- At the service provider outlet, the beneficiary must provide the e-RUPI QR code or SMS.

- This QR code or SMS must be scanned by the salesperson.

- Now, the beneficiary will receive an OTP.

- This OTP must be shared with the service provider by the beneficiary.

- This OTP must be entered into the OTP box by the service provider.

- Now the service provider must click the continue button.

- The service provider will receive payment.

Contact The Department

- Visit the National Payments Corporation of India’s official website.

- The homepage will appear in front of you.

- On the homepage, select get in touch.

- A new page will now appear in front of you.

- You must fill out the following information on this new page:

- Name

- Email ID

- Contact

- Subject

- Description

- Captcha code

- Then press the submit button.

- You can contact the department by following this procedure.

View NPCI Office Contact Information

- Visit the official website of India’s National Payments Corporation.

- The homepage will appear in front of you.

- Now you must select the option get in touch.

- A new page will appear in front of you.

- You must scroll down the page.

- The details of NPCI offices can be found at the bottom of the page.

Helpline Phone Number

We have given you with all of the necessary information on e-RUPI digital payment in this post. If you continue to have issues, you can contact the department at its helpline number for assistance. The number to call is 18001201740.

FAQ’s

The e-RUPI digital payment system is already active at State Bank of India, HDFC, Axis, Punjab National Bank, Bank of Baroda, Canara Bank, IndusInd Bank, and ICICI Bank, according to NPCI.

Only banks that are authorised by the RBI to issue Prepaid Payment Instruments (PPI) and participate as Payment Service Providers (PSP) in the UPI ecosystem (referred to as the “Issuer”) can issue e-RUPI.

It is advantageous for corporations, according to the NPCI website, because it is an end-to-end digital transaction that does not involve any physical issuance. As a result, the organization’s costs will be reduced.