TS Aasara Pension Status:- Aasara means “to support,” and that is exactly what the Telangana government is doing for all of the people who are unable to earn financial resources because they are unable to work and bear the burden of providing for their families due to illness or inability to work. So, in today’s article, we’ll discuss an important feature of the Telangana Aasara Pension Scheme for the year 2024 with our readers. We’ll also go over how to apply for the TS Aasara Pension in this article. We’ll also go through the eligibility requirements, how to check the progress of your application, what documents you’ll need, and everything else about the plan.

Table of Contents

TS Aasara Pension 2024

The Chief Minister of Telangana created the TS Aasara Pension program in 2014 to provide pensions to all individuals, including widows, HIV patients, and others so that they can provide for their families and live happy life. The Telangana Aasara Scheme has now been renewed for the year 2024, and the pension amount has been enhanced, allowing all beneficiaries to profit more from the scheme. They will no longer be required to work because they are ill. Click to Check Rythu Bandhu Status

Latest Update: Telangana Aasara Pension for Beneficiaries Age Between 57-65

As you may be aware, the Telangana government offers the TS Aasara Pension to those over the age of 65. During the 2018 election campaign, Telangana Chief Minister K Chandrasekhar Rao vowed to extend the scheme’s benefits to persons aged 57 to 65. All eligible candidates are asked to apply to the society for the elimination of rural poverty, which is part of the department of rural development. This scheme is open to everyone who is 57 years old on the date they submit their application. Eligible beneficiaries can apply in the required format at Meeseva centers.

Telangana Aasara Pension Benefits

The availability of financial capital, which would be distributed to all Telangana Aasara Pension Scheme 2024 recipients, is one of the scheme’s key features. As we all know, many individuals in our country are very sick and are unable to work as a result of their illness, thus by implementing this program, many people will be able to provide for their families even if they are unable to go out and work. The TS Aasara Pension comes with a slew of advantages that will be distributed to all participants.

Socio-Economic Criteria Under TS Aasara Pension

People who live in homes that meet one or more of the following criteria are not eligible for a social security pension:-

- Automobile owners, whether they drive light or a large vehicles (four-wheeler and big vehicles).

- You may already be receiving a pension from another government program or you may be eligible for a freedom warrior pension.

- Being the owner of a major business.

- Having doctors, contractors, professionals, and self-employed children.

- Any other criteria that the verification officer may use to determine if the household is eligible based on its lifestyle, occupation, or profession.

- Having more than 3 acres of wet/irrigated dry land or more than 7.5 acres of dry land.

- Having children who work for the government, the public sector, or the private sector on a contract basis.

If they are not on the exclusion list, households meeting the following socioeconomic requirements and falling into the above age range must be evaluated for inclusion and therefore eligible for pension:-

- Tribal groups are primitive and vulnerable.

- Households with no able-bodied earning members are headed by women.

- If a home has a person with a handicap, only one family member will be eligible for all of the pensions, including disabled and window pensions.

- Households that are homeless.

- Households reside in temporary shelters or huts, often in urban settings.

- Those households are headed by widows or terminally ill/disabled/persons aged 65 or more who have no other source of income.

- Agricultural laborers who are landless.

- Rural artisans/craftsmen.

- Slum-dwellers.

- People who make a living in the informal sector on a daily basis and others in similar categories.

Identification Of Eligible Persons for Pension

- The gram panchayat secretary/village revenue officer in the rural region and the bill collector in the urban area will accept the application.

- The above-mentioned officials are in charge of verifying and confirming the applications.

- The scrutinizing method will be done by a selected Mandal Parishad Development Officer/municipal commissioner/deputy/zonal commissioner, who would sanction their pension based on the criteria provided to them on a regular basis.

- The data from the household survey, the census population figure, and the percentage of old age widows and handicapped will be kept in mind for each Panchayat Mandal and municipality, as well as ensuring equity among various social categories such as scheduled caste, scheduled tribe, backward class, and so on.

- If a person provides false information in order to receive a pension, disciplinary action will be taken against them, and the money granted to them will be reclaimed.

TS Aasara Pension Objective

The TS Aasara Pension’s major goal is to provide financial assistance to the elderly, disabled, HIV patients, and single women so that they can maintain their families without working. People’s financial circumstances will improve as a result of the execution of this strategy, resulting in an improvement in their living standards.

Administration Of TS Aasara Pension

- All district collectors, the CEO, and the SERP will be in charge of putting this scheme online.

- It is necessary to follow strict protocol when making modifications to the database or processes unless the government has issued instructions.

- The appropriate data security must be guaranteed.

- Authorized alteration requests can be granted after receiving approval from the responsible authorities.

- After receiving a documented change request from the authorized officer, the software vendor is allowed to make changes.

- The report on the management information system will be available on the official website, which will be open to everyone.

- Administrative costs of not more than 3% of the total expenditure can be used for the implementation of TS Aasara pensions.

TS Aasara Pension Revised Pension Amount

Telangana’s government has introduced the TS Aasara Pension 2021 after making several changes. Beneficiaries’ pension amounts have been increased as a result of these adjustments. The following are the details of the pension amount: –

| Beneficiary Category | Old Amount | Revised Amount |

| Disable Persons | 1000 | 3000 |

| Single Female | 1000 | 2000 |

| Beedi Labourers | 1000 | 2000 |

| Filaria Patients | 1000 | 2000 |

| HIV Patients | 1000 | 2000 |

| Old Age Pension | 1000 | 2000 |

| Disabled Person | 1000 | 2000 |

| Weavers | 1000 | 2000 |

| Disabled | 1000 | 2000 |

| Widows | 1000 | 2000 |

TS Aasara Pension Eligibility

Different eligibility requirements have been set for the various groups of beneficiaries who are eligible to participate in the Telangana Aasara pension system in 2020:

- The age limit for old age is 65 years and up.

- The applicant must be a member of a primitive or vulnerable tribe.

- Only one family member, ideally a woman, is eligible for a pension.

- Landless agricultural laborers, rural artisans/craftsmen, slum dwellers, and people who make a living in the informal sector, such as porters, coolies, rickshaw pullers, hand cart pullers, fruit/flower sellers, snake charmers, rag pickers, cobblers, and other similar categories, are all eligible, regardless of whether they live in rural or urban areas.

- Homeless and houseless households, particularly in urban areas, who are live in temporary informal facilities or huts, are eligible.

- Households headed by widows or terminally ill/disabled/persons aged 65 and up who have no reliable source of income or societal support are also eligible.

For Widow-

- Age must be above 18 years for widows

- The applicant must be a member of a primitive or vulnerable tribe.

For Weavers-

- Age must be above 50 years for widows

- The applicant must be a member of a primitive or vulnerable tribe.

- A family’s pension can only be used by one person.

- A person’s occupation should be weaving, regardless of whether they live in the country or the city.

For Toddy Tappers

- Age should be above 50 years.

- The applicant must be a member of a primitive or vulnerable tribe.

- The person’s profession should be Toddy Tapping, regardless of whether they live in rural or urban locations.

- Verification of whether the beneficiary is a registered member of the Co-Operative Society of Toddy Tappers is required for Toddy tapper pensions.

For Disabled Person-

- The scheme is open to people of all ages who are disabled.

- The applicant must be a member of a primitive or vulnerable tribe.

Documents Needed for TS Aasara Pension

- Aadhaar Card

- Address Proof

- Income Certificate

- Proof of age

- Death Certificate in case of a widow

- Xerox copy of registration in the Cooperative society of Toddy Tappers.

- Weavers should submit a Xerox copy of registration in the Co-operatives society of weavers.

- SADAREM Certificate in the case of persons with disabilities 40% or above and 51% in respect to the hearing impaired.

- Bank Account Passbook

- Post Office Saving Account

- IFSC Code

- Photograph

- Mobile Number

Ts Aasara Pension Online Apply

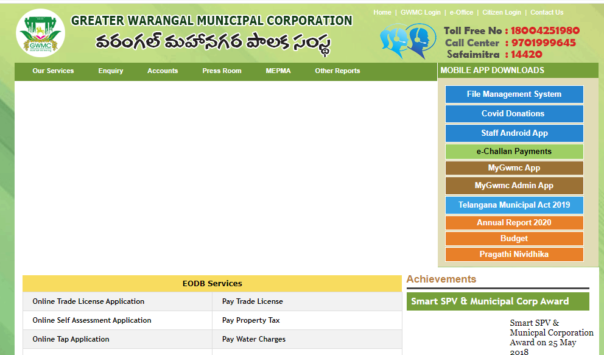

- To begin, go to the Greater Warangal Municipal Corporation’s official website.

- The homepage of the website will appear on the screen.

- Go to the “online application” section of the home page and pick “pension application.”

- Fill out the application form with all of the essential information.

- Aadhaar card, FSC card, bank account passbook, property tax receipt, and self-declaration are all required papers to upload.

- Click the submit option to submit the application form.

TS Aasara Pension 2024 Offline Application Process

If you want to take advantage of the program, you must complete the following application: –

- To get started, go to this page and click on the link.

- The application needs to be downloaded.

- Complete the boxes.

- Attach the necessary documentation.

- In the rural region, submit your application to your Regional Gram Panchayat Secretary / Village Revenue Officer, and in the urban area, submit it to the Bill Collector.

TS Aasara Pension Status Check Online

- If you want to check the progress of your application form, simply follow the instructions below:

- To begin, go to the following website.

- Click the “Search Beneficiary Details” option on the homepage.

- Fill in your Application Number, District, Panchayat, and all other necessary information.

- Select the search option.

How to Find a Pensioner’s Information

- Visit Aasara, the Society for the Elimination of Rural Poverty’s official website.

- You must choose the “quick search” option from the website’s home page.

- It will then provide the “Search Pensioner Details” option.

- When you click on it, a new page will appear where you must fill in the requested information, such as your name and address.

- Pensioner ID/ SADAREM ID

- District

- Mandal

- Panchayat

- Name

- Head of The Family

- When you choose the search option, information will appear on the screen.

Sanction Of Pension Amount And Issue Of Pension Card

- Examine the suggestion report and compare it to the results of the SKS survey.

- Identify the lowest of the poor from a confirmed list that includes people from all walks of life.

- Every effort will be made to ensure that no eligible beneficiary is overlooked.

- The data will then be entered into the Aasara program.

- The information will be forwarded to the district collector as well.

- The pension cards will be delivered to the appropriate beneficiaries after receiving final permission from the district collector and affixing the beneficiary’s photo.

- The gram panchayat is required to keep registers a and b, in which existing pensioners and those who are qualified but have not been considered for the pension are listed.

Aadhaar Seeding Under TS Aasara Pension

Payments will be made using biometrics if the following requirements are met:

- Beneficiaries will be given an Aadhaar number, which would be seeded immediately to enable biometric authentication and best payment through the Aadhaar-enabled payment system.

- They will obtain an Aadhar number with the help of the local authority if one is not available.

- The payment will be made using either the best fingerprint detection or incorrect IRIS authentication.

- In circumstances when patients are immobile or their upper extremities are severely afflicted, a gram panchayat secretary or bill collector will disburse the pension using his own biometrics.

Release Of Amount For Disbursal Of Pension

The MPDO will send the following information to SERP in order for the money to be released to the districts for disbursement: –

- At the state level, the software will generate the centralized acquittances as well as the proceedings.

- It will be posted on the internet in order to obtain the district collector’s approval of the processes through the project director.

- The project director will obtain approval from the district collector on the physical file before uploading it to the Aasara software.

- After that, SERP will generate a fund transfer report.

- The MPDOs / tahsildars will use the login provided to them to download the acquittances and print them out to send them to the disbursing agencies.

- The pension will thereafter be disbursed by the customer service provider at the gram Panchayat or disbursing point level.

- The signed acquittances will then be returned to MPDO/Tehsildars.

- Every month, the customer service provider, branch postmaster, gram panchayat, and secretary shall report on any changes in pensioners’ status.

Disbursal Of Pension

- The pensioner must have a bank account to which his or her pension should be deposited.

- If an ATM is provided in a municipality, the amount of the pension will be limited to the beneficiaries bank accounts, which they can withdraw using their ATM cards.

- In remote locations where a bank exists, the pension will be deposited in the post office’s local bank and disbursed via biometric authentication.

- The biometric device should have been registered by each retiree.

- As far as feasible, pension payments will be made in a public area.

Disbursement Cycle Under TS Aasara Pension

| Activity | Date |

| Disbursement of pension | 1st to 7th of every month |

| Sharing of disbursement data through biometric/IRIS authentication to SSP Server by the pension disbursing agency | Direct hitting on real-time basis |

| Return of the signed acquaintance by the pension disbursing agency to the MPDO/Municipal commissioner | 9th of every month |

| Remittance of the undisbursed amount from pension disbursing agency directly to state nodal account | 9th of every month |

| Generation of acquittances for the subsequent month | 16th to 21st of every month |

| Approval of preceding by the district collector | 22nd or 23rd of every month |

| Request for fund transfer by project director, DRDA on securing the approval of district collector | 22nd or 23rd of every month |

| Approval of fund transfer request by the SERP after securing the approval of the district collector | 23rd or 24th of every month |

| Funds for disbursement of pension to be reached to the concerned PDAs from the SNA | 25th of every month |

Procedure to Get TS Aasara Self Declaration Certificate

- First and foremost, you must visit the Greater Warangal Municipal Corporation’s official website.

- In front of you will appear a homepage.

- On the home page, go to the online application section and click on pension application.

- Now you must select “self-declaration download“.

- The application will be downloaded.

- You can fill out this form by printing it.

How to Complete Pension Eligibility Criteria

- To begin, go to the Greater Warangal Municipal Corporation’s official website.

- The home page will appear in front of you.

- On the homepage, go to the online application section and click on pension application.

- After that, select Pension Eligibility Criteria.

- A new page will open up in front of you.

- A PDF file can be found on this new page.

- The pension eligibility conditions can be found in the PDF file.

Your Pension Dashboard

- Visit the Greater Warangal Municipal Corporation’s official website.

- The home page will appear in front of you.

- Now, go to the online application section and select the pension application.

- After that, go to the pension dashboard and click on it.

- A new page will open up in front of you.

- You can see the pension dashboard on this new page.

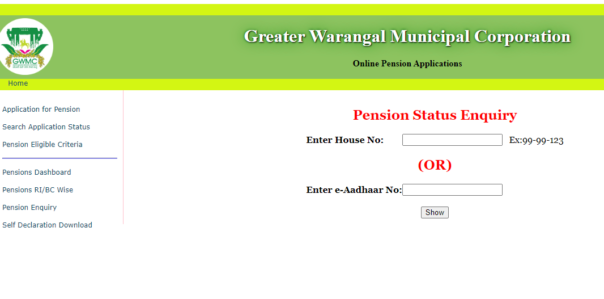

Make a Pension Inquiry

- Visit the Greater Warangal Municipal Corporation’s official website.

- The home page will appear in front of you.

- On the homepage, go to the online application section and click on pension application.

- Now you must select Pension Inquiry.

- After that, either your residence number or your e-Aadhar number must be entered.

- Now you must select Show.

- The necessary information will be displayed on your computer screen.

View Pensions by RI/BC

- To begin, go to the Greater Warangal Municipal Corporation’s official website.

- The home page will appear in front of you.

- Now, go to the online application section and click on the pension application.

- After that, you must select PENSION APPLICATIONS RI/BC WISE

- A new page will display on your screen as soon as you click this link.

- You can find the necessary information on this new website.

FAQ’s

Visit the Greater Warangal Municipal Corporation’s official website.

The home page will appear in front of you.

On the homepage, go to the online application section and click on the pension application.

You must now click on the login button.

After that, you must choose a designation.

Your login, password, and captcha code must now be entered.

After that, you must click the login button.

You can access the portal by following this approach.

You can reach us at toll-free number 18004251980 or call center number 08702500781 if you have any questions.

The age limit for old age is 65 years and up.