Karnataka Crop Loan Waiver List:- The government has begun to reach out to farmers with a loan waiver program to lend a helping hand during their difficult times. A program called the Karnataka Crop Loan Waiver Scheme was introduced by the JD(S)-Congress coalition for the benefit of the state’s farmers. The Karnataka Crop Loan Waiver List offers qualifying farmers financing on crops. Farmers in Karnataka have benefited greatly from the crop loan mafi scheme. As a result, all states have adopted the CLWS program, including Karnataka. By giving farmers crop loans, the main goal is to strengthen their financial position. Read below to get detailed information related to the CLWS Crop Loan Waiver List like highlights, objectives, benefits, components, eligibility criteria, and documents required, check the report or Karnataka Crop Loan Waiver Status, search your name in the Farmer List, and much more

Table of Contents

Karnataka Crop Loan Waiver List 2024

The loan waiver program has been a significant contributor to India’s advantages. To help the nation’s farmers, numerous states lately and in the past introduced their loan forgiveness programs. The loan waiver program has now been introduced by the Karnataka government, which will help the state’s farmers and erase any excess debt they may have accumulated. All of the farmers in the state of Karnataka will experience a sense of community as a result of the scheme’s adoption. The best aspect is that the relevant department provides a list of shortlisted farmers who will not be required to repay a loan. This has made it easier for the farmers to carry their load.

clws.karnataka.gov.in List Details Highlights

| Scheme Name | Karnataka Crop Loan Waiver List |

| Introduced by | Karnataka State |

| Launched On | 17th December 2018 |

| Scheme Beneficiary | State’s Small & Marginal Farmers |

| Objective | To waive crop loans up to 2 Lakh rupees |

| Official website | http://clws.karnataka.gov.in/ |

Karnataka Crop Loan Waiver Objective

- The major goal of the Karnataka loan waiver scheme, which was introduced by the Karnataka government in 2018, is to wipe off all agricultural loans up to Rs. 200000 to lessen the financial burden on farmers.

- Assisted farmers after a double drought hit

- Loans secured for the upcoming season’s planting

- Farmers on the margins and in poverty receive more loans.

Karnataka Ganga Kalyana Scheme

Benefits of Karnataka Crop Loan Waiver

The program was initially introduced in December 2018, and as a result, the Chief Minister of Karnataka State made a promise to the state’s residents that their loans would be canceled as soon as the program went into effect. After a year, the Karnataka loan waiver scheme’s recipient list is finally public, and the relevant authorities have canceled the farmers’ loans. The primary advantage of the plan is the lessening of the financial load that farmers formerly carried.

Karnataka Crop Loan Waiver Components

The relevant authorities have developed a special webpage that will handle the tasks associated with the Karnataka loan waiver program. The recipients and officials can use the following four alternatives on the official website:

- For Commercial Bank

- Bank manager login

- Bank deo login

- Bank fsd login district wise

- Clws bank reports

- Branch-Wise Crop Loan Waiver Payment Certificate

- For Citizen

- Individual loanee report

- Citizen payment certificate for banks

- Citizen payment certificate for pacs

- For Cooperative Bank

- Taluk cdo login

- Pacs deo login

- Dcc taluk manager login

- Pacs fsd login district wise

- Pacs wise crop loan waiver payment certificate

- Clws pacs reports

- Arcs login

- For Nadakacheri

- Bank fsd login district wise

- Citizen payment certificate for pacs

- Citizen payment certificate for banks

- TLC fsd login

- Services For Taluk Level Committee

- TLC pacs mismatch reports

- pacs mismatch verification login

- Taluk Level bank mismatch verification login

Eligibility Criteria

The eligibility criteria for Karnataka Crop Loan Waiver are as follows:

- Applicants must be a resident of the Karnataka state

- Family members of farmers should not take government or officer positions.

- Loans are exclusively given out for agricultural purposes.

- Loans up to Rs 2 lakh are made available

Documents Required

The documents required for Karnataka Crop Loan Waiver are as follows:

- Identity Proof like Aadhar Card

- Passport photo

- Residence proof

- Income Certificate

- Bank Passbook

- Secondary Documents need to be attached

Steps to Check CLWS Crop Loan Waiver Status

To search your name in the Farmer List, the user needs to follow the below-given steps:

- First of all, go to the official website of the scheme i.e., https://clws.karnataka.gov.in/

- The homepage of the website will open on the screen

- Click on the Services for Citizen Option

- Various options will open on the screen like:

- Individual Loanee Report

- Citizen payment certificate for pacs

- Farmer Wise Eligibility Status

- Citizen payment certificate for banks

- Crop Loan Waiver Report

- Click on the Farmer Wise Eligibility Status option

- A new page will open on the screen

- Now, select your district, bank, branch, and IFSC code

- After that, click on the fetch details button

- Finally, the Commercial Bank Individual Farmer Report will open on the screen

Search Name in Waiver List 2024

To check the report or Karnataka Crop Loan Waiver Status, the user needs to follow the below-given steps:

- First of all, go to the official website of the scheme i.e., https://clws.karnataka.gov.in/

- The homepage of the website will open on the screen

- Click on the Services for Citizen Option

- Various options will open on the screen like:

- Individual Loanee Report

- Citizen payment certificate for pacs

- Citizen payment certificate for banks

- Crop Loan Waiver Report

- Farmer Wise Eligibility Status

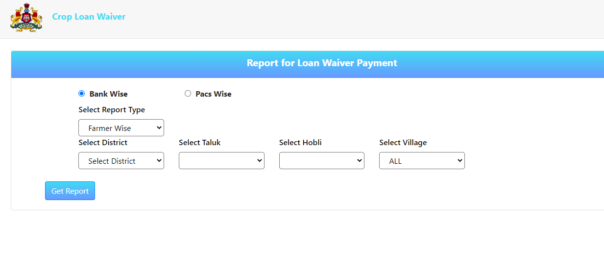

- Select Crop Loan Waiver Report and click on it

- A new page will appear.

- Select the bank wise or pacs wise option.

- Now select the report type as farmer wise

- Now select district, talluk, hobbli, and village.

- Click on the Get Report option.

Information in the Report

The following information will appear on your screen when you eventually receive your report:

- Information on commercial bank loans includes CLWS ID, District and Taluk names, Bank and Branch names, Farmer Names, Ration Card Numbers, Loan Type, Account Number, and Status.

- Information about bank payments, such as the CLWS ID, loanee’s name, account number, kind of loan, payment status, and date of payment

- Bank Payment Information: Report, CLWS ID, District, Taluk, Bank, Branch, Farmer, Ration Card No., Loan Type, Account Number, and Status are examples of PACs Loan Details.

- PACs Loan Information: Details about Pacs payments, including CLWS ID, loanee name, account number, loan type, and paid date.

Taluk Level Committee Services

The Taluk Level Committee Services are as follows:

- TLC Bank Mismatch Verification Login

- TLC PACS Mismatch Verification Login

- TLC PACS Mismatch Reports

- FSD LOGIN

- TLC Abstract Reports

- Bank Mismatch Reports

Contact Details

- Address: Bhoomi Monitoring Cell, SSLR Building, K.R. Circle, Bangalore – 560001

- Email id: BhoomiCLWS@gmail.com

- Phone Number: 080-22113255

- Helpline Numbers:

- 8277864065

- 8277864067

- 8277864068

- 8277864069