RBI Udgam Portal:- Unclaimed Deposits Gateway to Access (UDGAM) is a centralized web platform that was introduced by the Reserve Bank of India (RBI) on Thursday. The RBI has created this portal for the general public’s use in order to assist and make it simpler for consumers to search their unclaimed deposits across many banks in one location. Read the complete post to get complete information related to the udgam.rbi.org.in Portal including Highlights, Objectives, Benefits & Features, Process to Register, Login, and much more

Table of Contents

RBI Udgam Portal 2023

The Reserve Bank of India has announced the introduction of a centralized web tool for tracking up unclaimed deposits as part of the announcement on developmental and regulatory policies dated April 6, 2023. The RBI has periodically launched public awareness programs to educate the public on this issue in light of the rising trend in the number of unclaimed deposits. Additionally, the RBI has urged the public to locate and contact their particular banks to claim unclaimed deposits through these measures.

udgam.rbi.org.in Portal Details in Highlight

| Portal Name | RBI Udgam Portal |

| Full Form | Unclaimed Deposits – Gateway to Access Information |

| Initiated by | Reserve Bank of India (RBI) |

| Beneficiaries | Indian Citizens |

| Official Website | https://udgam.rbi.org.in/ |

RBI Udgam Portal Objective

Customers would find it simpler to identify their unclaimed deposits and accounts due to the establishment of the web portal, offering them the choice of either activating their deposit accounts at their individual banks or withdrawing the deposit amount.

RBI Udgam Portal Benefits & Features

The main benefits and features of the RBI Udgam Portal are as follows:

- Reserve Bank of India (RBI) announced the introduction of UDGAM (Unclaimed Deposits – Gateway to Access Information).

- The establishment of the web portal would make it easier for consumers to locate their unclaimed deposits and accounts, giving them the option to either make their deposit accounts active at their respective banks or collect the deposit amount.

- Participating banks, Indian Financial Technology & Allied Services (IFTAS), and Reserve Bank Information Technology Pvt Ltd (ReBIT) collaborated to develop the platform.

- The search feature for the remaining banks on the platform will gradually be made available by October 15.

- The users will have access to details about their unclaimed deposits for the seven banks that are already represented on the platform.

Banks Listed under RBI Udgam Portal

The following seven banks are now accessible on the RBI Udgam portal, and users will initially be able to view information regarding their unclaimed deposits in respect to them:

- Punjab National Bank

- Central Bank of India

- Citibank N.A.

- State Bank of India

- DBS Bank India Ltd.

- Dhanlaxmi Bank Ltd.

- South Indian Bank Ltd.

Why is RBI Udgam Portal Required?

If any deposits are not used for ten years, they are classified as “Unclaimed Deposits” in a savings, current, or fixed deposit. According to the definition of unclaimed deposits, these are “balances in savings/current accounts that are not operated for 10 years, or term deposits that are not claimed within 10 years of the maturity date. These funds are transferred by banks to the Depositor Education and Awareness (DEA) Fund of the Reserve Bank of India. Even after the money is transferred to the DEA, bank depositors have the right to retrieve unclaimed monies from the bank where they were held, together with any interest that has accumulated.

In a statement from July 2022, the RBI noted that the number of unclaimed deposits was increasing despite efforts to raise public awareness. The amount of unclaimed deposits is trending upward, notwithstanding sporadic public awareness campaigns by banks and the RBI.

What Causes the Increased Unclaimed Deposits?

According to a news release from the RBI dated July 22, 2022, depositors’ failure to shut departing savings or current accounts or their failure to notify banks of redemption requests for fixed deposit maturities are the main causes of the rising number of unclaimed deposits. Other times, the legal heirs or nominees of deceased depositors choose not to file a claim against the bank or banks in question.

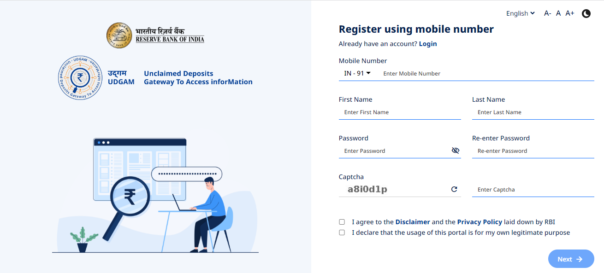

Process to Register on the RBI Udgam Portal

The process to register on the portal is given below:

- Firstly visit the official website of RBI Udgam Portal i.e., https://udgam.rbi.org.in/

- The homepage of the website will open

- Click on the Register link

- The registration form will be displayed on your screen

- Now, enter all the required information like name, mobile number, password, etc

- After that, enter the captcha code, and accept the declarations

- Proceed further and click on the next button

- A new page will open on the screen

- Now, enter all the other required information

- After that click on the register button to complete your registration process

Process to Login on the RBI Udgam Portal

The process to login on the portal is given below:

- Firstly visit the official website of RBI Udgam Portal i.e., https://udgam.rbi.org.in/

- The login window will open on your screen

- Now, enter all the required details like your mobile number and the password

- After that, enter the captcha code and click on the next button to get logged in to your account

Contact Information

Contact the below given details for further information:

UDGAM Support Team: udat@rbi.org.in